Estimate taxes for 2021

If your employer does withhold Maryland taxes from your pay you may still be required to make quarterly estimated income tax payments if you develop a tax liability that exceeds the amount withheld by your employer by more than 500. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

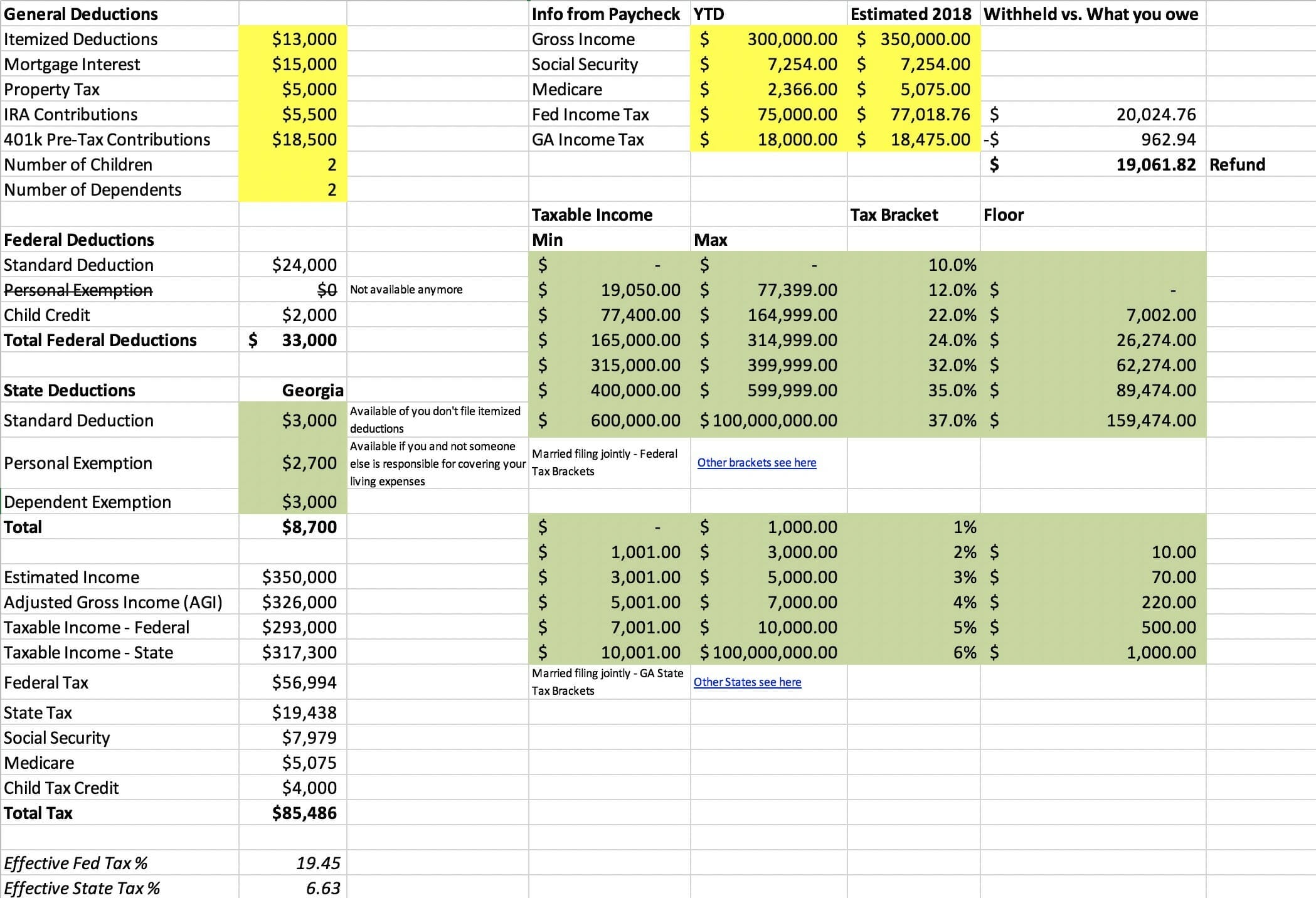

2020 2021 Tax Estimate Spreadsheet Income Tax Capital Gains Tax Tax Brackets

Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April.

. E-File your tax return directly to the IRS. If you receive 500 or more in income from awards prizes lotteries racetracks or raffles you must file Form. You receive certain types of taxable income and no tax is withheld or.

2nd Quarter - June 15 2022. There is a separate payment form for each due date. Your tax situation is complex.

Enter the federal adjusted gross income you calculated in Step 1 on Form M1 line 1. 2022 Payment Due Dates. See Publication 505 Tax Withholding and Estimated Tax.

Prepare federal and state income taxes online. Enter your income and other filing details to find out your tax burden for the year. Write your SSN or ITIN and 2022 Form 540-ES on it.

Youll pay 10 on the first 19900 of taxable income and 12. Enter your filing status income deductions and credits and we will estimate your total taxes. Income Tax Calculator 2021.

An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make. Information and interactive calculators are made available to you as self-help tools for your. Discover more science math facts informations.

Use Estimated Tax for Individuals Form 540-ES 5. You should make estimated payments if your estimated Ohio tax liability total tax minus total credits less Ohio withholding is more than 500. Estimated payments are made quarterly according to the following schedule.

Use this free tax return calculator to estimate how much youll owe in federal taxes using your income deductions and credits in just a few steps. Divide the amount you owe by four to get each payment. And is based on the tax brackets of 2021 and 2022.

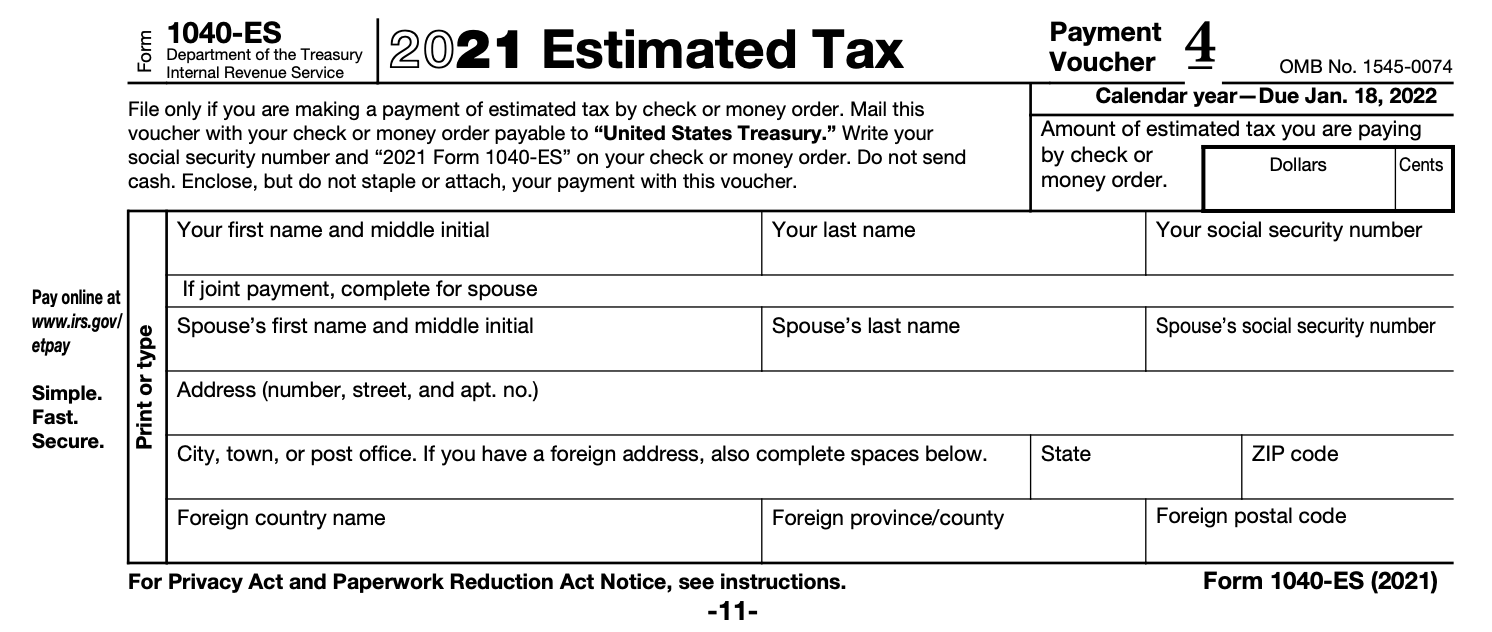

Make your check or money order payable to the Franchise Tax Board. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator. When you prepare your 2021 return well automatically calculate your 2022 estimated tax payments and prepare 1040-ES vouchers if we think you may be at risk for an underpayment penalty next year.

Estimated tax is the method used to pay tax on income when no taxor not enough taxis withheld. You have nonresident alien status. Then income tax equals.

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. You may be required to make estimated tax payments to New York State if. You are subject to the MCTMT.

Use our income tax calculator to estimate how much youll owe in taxes. Estimate your tax withholding with the new Form W-4P. The 2022 tax values can be used for 1040-ES estimation planning ahead or.

This includes alternative minimum tax long-term capital gains or qualified dividends. 10 of the taxable income. Use Form M1 Individual Income Tax to estimate your Minnesota tax liability and credits for the year.

Ad Free means free and IRS e-file is included. Single Individuals Not over 9950. 3rd Quarter - Sept.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with Extension Request to 2021 Estimated Taxes. Taxes must be paid as you earn or receive income during the year either through withholding or estimated tax payments.

Log in and select Make an Estimated Payment See the instructions for Form 760 760PY or 763 for more on computing your estimated tax liability. Estimate My 2021 Tax Return Your Account Start a New Account Login to My Account. Max refund is guaranteed and 100 accurate.

See How Easy It Is. Complete Form M1 using the Minnesota income tax rates for the current year and your filing status. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Examples of workers who might have to make estimated tax payments. 1st Quarter - April 18 2022. Vouchers to pay your estimated tax by mail.

Use this package to figure the estimation of tax in 2021 TY. Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars. Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes.

It is mainly intended for residents of the US.

Click Here To View The Tax Calculations Income Tax Income Online Taxes

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Federal Income Tax

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Minnesota W4 Form 2021 W4 Tax Form Tax Forms Filing Taxes

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Financial Planning Guide 2021

Everything You Need To Know About Estimated Taxes In 2021 Estimated Tax Payments Money Basics Business Finance

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Free Income Tax Calculator Estimate Your Taxes Smartasset Income Tax Income Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

Turbotax Taxcaster Free Tax Calculator Free Tax Refund Estimator Tax Refund Turbotax Finance Apps

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet